california mileage tax bill

As independent contractors in California were getting a handle on how earning Form 1099 income could affect their employment status under Assembly Bill 5 AB 5 the state enacted a new law to further revise the state laws governing independent contractors. Even if you.

Vehicle Miles Traveled Tax Proposed

Thats important to know.

. Department of Energy. The only gas mileage calculator that calculates gas mileage and toll costs across states in United States and provinces in Canada for trucks from 2-axles to 9-axles. Victims of wildfires that began July 14 2021 now have until January 3 2022 to file various individual and business tax returns and make tax payments following the recent Federal Emergency Management Agency decision to end the incident period for.

Employers must compensate their employees for a reasonable percentage of the employees cell phone bill under Section 2802. The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes. Use for gas calculator gas mileage IFTA tax truck gas mileage miles calculator mileage rate calculator google mileage calculator and IFTA fuel tax.

Provide an odometer mileage certification If your vehicle is less than 10 years old. Doordash does not track mileage for you. As an independent contractor you can knock the standard mileage deduction of 56 cents per mile 2021 or 585 cents in 2022 from your revenue.

The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed. Schwans Home Serv Inc 228 Cal. The newest hybrid cars can get 50 mpg or more and plug-in hybrids can get the equivalent of hundreds of miles per gallon.

If you pull the full 50000 out at once youll get the full deduction. 5000 Introduction 5005 Auto Auctions 5010 Certificate of Title 5015 Court Actions 5020 Disclosure Features 5025 Disclosure Requirements 5030 Errors in Reporting Odometer Mileage 5035 Information Recorded on the Certificate of Title 5040 Leased Vehicles 5045 Original Applications 5050 Replacement or Conversion of an Odometer 5055 Repossessed Vehicles. Self-employed taxes in California just got a lot more complicated.

Sales tax is paid under the sellers. What is good gas mileage. If Doordash doesnt do this or do it well then its up to you.

You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons. You wont be on the hook for any penalties but that doesnt mean the extra is tax-free youll still have to pay tax on it when you file your annual return. For example say you inherit a 50000 IRA which because it was included in your mothers taxable estate boosted the estate tax bill by 20500.

The Tax Cuts and Jobs Act of. Tax help for taxpayers affected by the California wildfires flooding mudflows and debris flows. Claiming a deduction for mileage can be a good way to reduce how much you owe Uncle Sam but the government has tightened up mileage deduction rules in recent years.

California Vehicle Dealer SalesSales that include the appropriate dealer report of sale document and sales of American-made vehicles to foreign residents who obtain a Foreign Resident In-Transit 30-Day Permit. The Cochran case provides guidance on how to calculate a reasonable reimbursement for the mandatory use of personal devices such as cell phones. Knowing how many miles you drove means a smaller tax bill.

2006 requires payment of use tax on a vehicle purchased outside California and brought into California within 365 days of. For example say your gross income for the prior year was 50000 and it jumped up to 100000 for the current year. The overall average combined mpg of cars in 2020 reached 257 mpg which was a record high according to the US.

Although you have to pay tax as you pull money out of the IRA you also get a deduction for that 20500. Need to pay a bill make a change or just get some information.

Irs Raises Standard Mileage Rate For 2022

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

What Are The Mileage Deduction Rules H R Block

San Diego Driving Tax Locals Torn Over Per Mile Road Usage Tax Discussed By Sandag

Pros And Cons Of A Vehicle Mileage Tax Glostone Trucking Solutions

We Ll Need To Replace The Gas Tax In Transition To Zevs Calmatters

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group

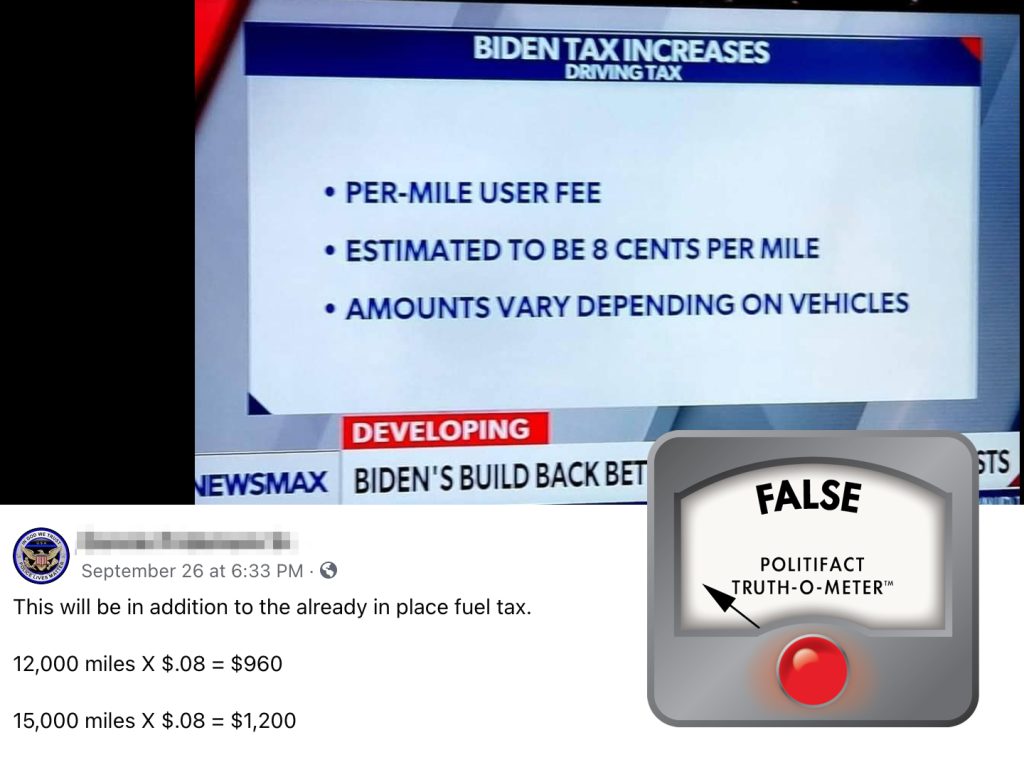

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

The Case For Taxing Vehicles Based On The Miles They Travel Nevada Current

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

Sales And Use Tax Regulations Article 11

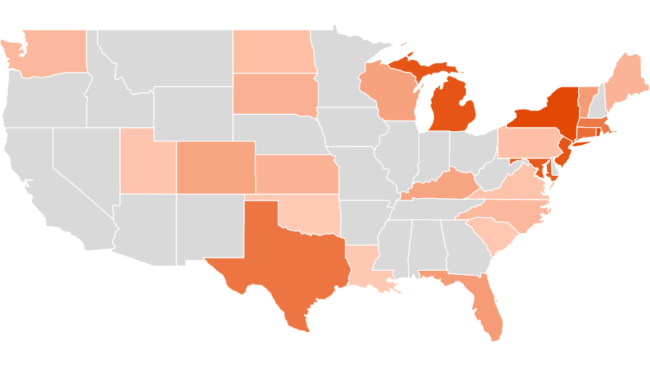

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

Sales And Use Tax Regulations Article 11

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Secured Property Taxes Treasurer Tax Collector